For both the purchase of supplies and inventory, once the company pays up its debt, the transaction will be recorded as a debit to the accounts payable and a credit to cash. Continuing the example above, when the clothing retail company pays up its debt to the haute couture manufacturer, the following journal entry will be made to record the transaction. Since all purchases must be paid either immediately or after some time, it means the company’s cash will decrease while the account for what was purchased will increase. Hence purchase is always recorded as a debit to the supplies expense or inventory account and a credit to cash or accounts payable. When companies purchase supplies or inventory, they either pay in cash or make the purchase on credit. For either of these purchases, a debit and credit journal entry has to be made in order to record the transaction.

The key factor that qualifies a purchase as a cash purchase is that the payment is made immediately after the purchase is made. When a cash purchase is made, two accounts are involved; the purchase account and the cash account. The purchase account is debited to signify the increase in expense while the cash account is credited to signify a decrease in assets. Purchase is an expense that is included on the income statement within the cost of goods sold if it is incurred for purchasing raw materials that are used in the manufacturing process. Every company that is in existence has had reasons for purchasing equipment, inventory, or assets that aid in their day-to-day operation.

The double entry is same as in the case of a cash purchase, except that the credit entry is made in the payable ledger rather than the cash ledger. The purchase of pens is recorded as supplies because the pens are items that will be used by the company’s employees in daily business operations. When you post an inventory receipt, Acctivate will utilize the Inventory and Purchases GL account specified on the Warehouse. Creating the Vendor Bill reconciles the balance in the Purchases account into Accounts Payable. If we understand the difference between accounts and ledgers now we are all set to understand purchase ledger and purchase account distinction. When goods are stolen, it is also recorded with a credit to purchases account.

Our Team Will Connect You With a Vetted, Trusted Professional

Although it is termed a cash purchase, it does not necessarily mean the company pays for its purchase using dollar notes. Cash purchases also include payments made by cheques, bank transfers, card payments, cryptocurrency, etc. And both purchases account and machinery account will be maintained under General ledger. As purchase results in increase in the expense and decrease in assets of the entity, expense must be debited while assets must be credited. A purchase also results in increase in inventory, however the accounting for inventory is kept separate from accounting for purchase as will be further discussed in the inventory accounting section.

- Finance Strategists is a leading financial literacy non-profit organization priding itself on providing accurate and reliable financial information to millions of readers each year.

- Under the periodic system the account Inventory will have no entries until it is adjusted at the end of the accounting year so that it reports the cost of the ending inventory.

- Purchases could also be a barter transaction where the parties involved exchange a good for a service or vice-versa.

- In a nutshell, we can say that Ledgers are simply the registers where we keep T-accounts or T-accounts are kept in ledgers.

If you don’t have a receipt, please check I Need a Receipt for My Payment or contact us. If you can’t find an item in your purchase history at reportaproblem.apple.com, check the purchase history in Settings on your iPhone or iPad. Important – Due to the potential complications this can cause, our support team will be unable to resolve any issues caused by these kinds of purchases. I would like to present a particular point important when you are implementing Material Ledger, it’s the way of manage purchase account.

What is the Accrued Purchase Receipts Account?

I´d like to pick this on a different angle, do you have any source info (independent on ML or even SAP system) on when/why this purchase account management principle is mandatory? I ask this because I´ve worked on CoCds for those countries and sometimes it´s active and sometimes is not and apart from the IMG help there´s not a big deal of context/info around online. Periodical Total is entered in the debit side of the Purchases Account as ‘To Sundries as per Purchases Book’ in the particulars column, of the purchase account and the total amount is entered in the Amount column of the debit side. Emilie is a Certified Accountant and Banker with Master’s in Business and 15 years of experience in finance and accounting from corporates, financial services firms – and fast growing start-ups. Please reach out to the game support team with your receipt, and ask to transfer the purchase to the correct account.

Now as I said, we have specific journals and specific ledgers so it implies that business transactions are recorded and reported by grouping transactions which are of similar nature or characteristics. Purchase account is debited to record the journal entry for credit purchase. Purchase account is debited to record the journal entry for cash purchase. In the accounting general ledger, the credit balances of the contra purchase expense accounts reduce and offset the usual debit balances reported in the standard purchase expense accounts. Purchase Discounts, Returns and Allowances are contra expense accounts that carry a credit balance, which is contrary to the normal debit balance of regular expense accounts.

What is the approximate value of your cash savings and other investments?

Normally, when goods leave a business, the transactions are termed sales. However, in all of the above cases, purchases are reduced by crediting the purchases account, which is because no sales are happening. The approving official is responsible for ensuring that all purchases made by the account holder were appropriate and the charges accurate.

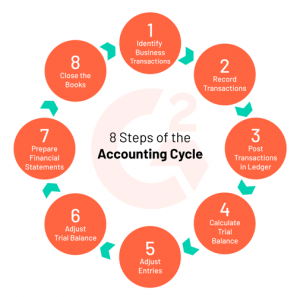

- If we remember, in an accounting cycle ledgers or in fact accounts within ledgers are populated by taking information from the journals.

- The cost of the ending inventory is computed through a physical count (or an estimate) and is subtracted from the cost of goods available to arrive at the cost of goods sold.

- The approving official is responsible for ensuring that all purchases made by the account holder were appropriate and the charges accurate.

- If you can’t find an item in your purchase history at reportaproblem.apple.com, check the purchase history in Settings on your iPhone or iPad.

- The entries are usually equal but opposite; this means that when one account reduces, another increase.

In the event an unauthorized purchase is detected, the AO must notify the A/OPC and other appropriate personnel in accordance with agency policy. After review, the AO will sign the account statement and maintain the documentation in accordance with agency procedures. Timely reviews of transactions are necessary to ensure detection of possible cases of account misuse and fraud. The AO should have direct knowledge of the account holder’s role in the agency and the ability to verify receipt of the purchase.

Journal Entry for Credit Purchase and Cash Purchase

At a later date, the payments can be partially or fully matched to the related invoice. Usually, customers are given a specific period in which to make full payment on a specific invoice, even when credit is extended. Purchases ledger is simply a collection of creditors’ T-accounts or an accounting book in which accounts of creditors are maintained. Under Purchases ledger also called as “Creditors Ledger” individual accounts of creditors from whom we have bought stock, services or any kind of assets are kept and updated accordingly. The recording of transactions in the purchase book is made on the basis of purchase invoices, which are received by the entity from the supplier, that bear the net amount, after deducting the trade discount. For the good that is lost, we need to show the decrease in value of inventory and we record this with a credit to purchases account.

The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

However it won’t have any impact with these keys in ML as these Purchase Account Management Entries will be generated as the offsetting entries only in GR and in the same GR document these accounts get net off to zero. ML will consider the original entries with BSX transaction key only as EKG & FRE always equal to EIN. Purchase Accounting helps to get the details of all purchases made during the period. Typically it is required for legal reporting in certain countries where companies need to present a purchase register to statutory reporting.

Under the perpetual system, the costs of the goods sold are removed from the account Inventory when the goods are sold and are recorded in the account Cost of Goods Sold. As a result, the balance in the account Inventory should be the cost of the ending inventory. In case of cash Purchase, the “Purchase account” is debited, whereas “Cash account” is credited with the equal amount.

In order to accurately make such journal entries, the supplies or inventory account are often used to record the purchase of supplies or inventory respectively. In accounting, the purchase is the cost of acquiring inventory with the aim of reselling them or purchasing assets that ease business operations. retained earnings calculation When goods or inventory is purchased, it is recorded on the company’s income statement as part of the cost of goods sold or supplies expense. When assets such as land, building, machinery, plant, and other assets are purchased, they are recorded on the balance sheet as fixed assets.

It is very important, for accuracy of accounting, to keep accurate records of all accounts payable and accounts receivable, and to match payments on account with their relevant invoices as soon as can be done so. The maintenance of accurate records and the proper classification of payments allows accounting ledgers to be correctly reconciled at the end of the month, quarter, or year. Although both the purchase of supplies and inventory result in the reduction of the company’s assets, accounting for them is not the same. Supplies are items companies use for their day-to-day operations such as highlighters, paper, pens, trash cans, etc.

Contrarily, Purchase Account is a summary of the total purchases made throughout the year, for trading or producing activity. The general ledger account Purchases is used to record the purchases of inventory items under the periodic inventory system. Under the periodic system the account Inventory will have no entries until it is adjusted at the end of the accounting year so that it reports the cost of the ending inventory.

In a nutshell, we can say that Ledgers are simply the registers where we keep T-accounts or T-accounts are kept in ledgers. To begin with, we need to clear one misconception that LEDGER is NOT T-Account. But still both of these terms are employed interchangeably by teachers and therefore students wrongly interpret ledgers to mean t-accounts or accounts.

As the purchase book only keeps the record of credit purchases, cash purchases are recorded in the cash book. So, it is necessary to refer to both while posting the transactions in the purchase account. The double-entry accounting method is used to record purchases made by a company.

My City Rewards is back for the 2023/24 Season – BCFC

My City Rewards is back for the 2023/24 Season.

Posted: Tue, 01 Aug 2023 14:39:01 GMT [source]

Purchases account is a T-account in which we only record value of purchases made in a particular period and this account is maintained under General Ledger. Please read the difference in stock purchase and fixed asset purchase from accounting perspective for more details about why we do not record all kind of purchases in Purchases account. When the payment of goods purchased from the seller, is made immediately by the buyer, using cash, card, cheque or via any online mode, it is called cash purchases.